Prepared by Wyth Financial

Prepared by Wyth Financial

"Our data volume has increased 110 percent year over year, our automated data loads have increased 28 percent YoY, and we have 128 users on the platform (more than 1/3 of our staff)."

COVID-19 increased the pace of change and we must change faster to survive. “If the rate of change on the outside exceeds the rate of change on the inside, the end is near,” said Jack Welch, CEO of GE. Fortunately, things are changing for the better at Wyth Financial (Formerly Concentra Bank)—we’re more informed, responsive and resilient than ever been before.

One way we’re responding to change is through the Data and Analytics Agile team and Centre of Excellence (COE). This team prioritizes data issues for resolution and assigns resources to execute the work. We’re moving to a data-centric view of our work, making our data readily accessible so we can collaborate to gain business insight and solve business problems. As Kelly Sanheim, Vice-President, Operational Excellence at Wyth notes, “Data is moving beyond information to insight.”

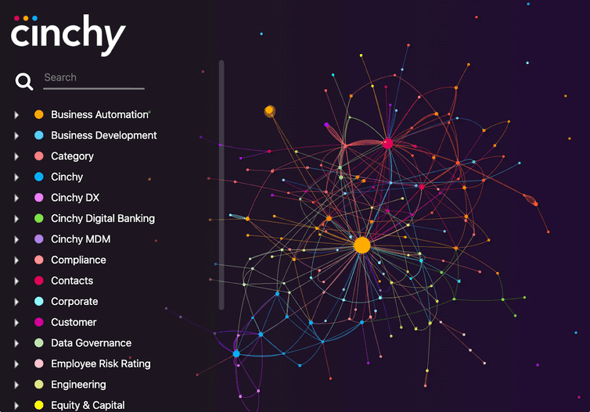

We’re visualizing the known connections in our data and creating a data fabric with Cinchy, an innovative software. This image highlights the data fabric we’re creating: the blue is the Cinchy data and the red is Wyth data. That’s a lot of data, enabling a lot of insight. Our data volume has increased 110 percent year over year, our automated data loads have increased 28 percent YoY, and we have 128 users on the platform (more than 1/3 of our staff).

Jamie Ledgerwood, Systems Architect, Information Management at Wyth notes, “Overall, Cinchy benefits both IT and business, where IT can reduce the effort required for Data Integration and the business can build a closer relationship with the data it manages to become a more data-centric bank of the future.”

In December 2020, Wyth launched 10 operational management boards for various lines of business. While this launch is version 1.0, we’re already seeing the benefits. Every two weeks, we present the information from these boards and other sources to the executive leadership team. We’re benefitting from better information and insight and our data is coming to life to enable our business change agenda.

Cammy Ouellette, Wyth’s Senior Director Analytics says that through this work we are creating a one-stop shop for analytics, insight and reports. As we continue to hook up our digital bank, execute automations and leverage the work of our Agile teams, we’re gaining momentum—becoming more resilient, adaptable and ready for change.

For example, our Risk Analytics implementation of new data standards paved the way for additional reporting automation for the residential mortgage portfolio. Our Risk, Residential Markets, IM and Operational Excellence teams collaborated to move away from manual reporting toward fully automated risk and compliance monitoring and reporting. We’re applying the lessons learned from this work to the automation of reporting for other credit portfolios, like commercial lending and equipment financing. This reduces effort and creates capacity while delivering more timely and actionable insight.

“Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion,” is another maxim of Jack Welch’s. Wyth has a vision and we’re working harder and smarter to deliver business as usual while bringing that vision to life.